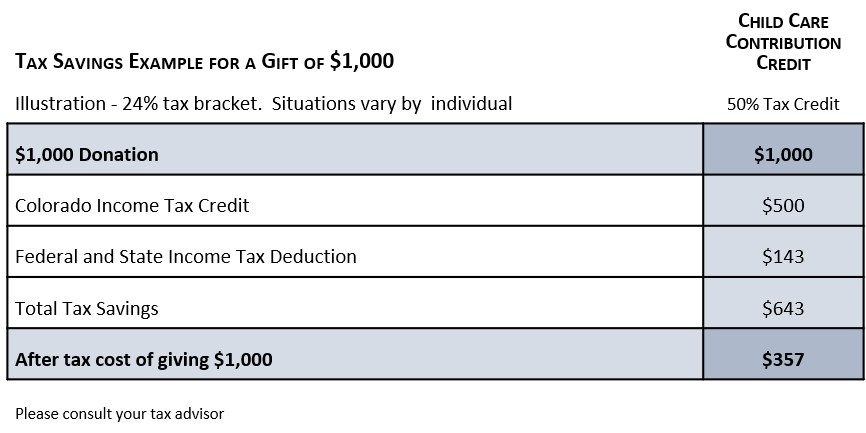

Your cash contribution to A Shared Vision qualifies for a 50% Colorado Child Care Contribution Credit on your state taxes.

|

About the Colorado Child Care Contribution Tax Credit

Your cash contribution to A Shared Vision qualifies for a 50% Colorado Child Care Contribution Credit. A Shared Vision donors who file a Colorado state tax return are eligible to claim the credit for qualifying contributions they make during the given calendar year.

What you receive:

The result:

At the end of each year we will mail you the necessary form to claim the credit for all qualifying gifts received during that calendar year. Donors should contact their tax advisor for advice regarding how to apply the credit as information here is not considered tax advice. For more information please visit the Colorado Department of Revenue Bulletin. Questions? Contact us at [email protected]. |